In the last several years, several studies have been conducted to see if consumers would be willing to try cell-based meat. As time has gone on, consumer interest in trying products has gone up.###A 2018 study by Kadence International asked consumers if they were interested in buying “clean meat” — terminology for cell-based meat that wa s pferrous sulfate and ferrous fumaratereviously used but has gone out of favor — found just 27% would. Later that year, an online survey found 40% of U.S. residents would be happy to eat cultured meat. And a 2019 study in Frontiers in Nutrition reported 65% of Americans would be willing to try cultured meat, with half willing to buy it reguzinc supplement hairlarly.###While this survey that has the most favorable results was done on behalf of a company making cell-based meat products, Eat Just says they were not involved with how the survey respondents were selected — something completely done by the outside firm. Compared to the prezinc supplement on carnivorevious studies that weren’t affiliated with the industry, this survey had a much larger sample size and a diverse population of respondents. Responses were demographically balanced, and respondents were people with incomes of $50,000 or more who had grocery shopped in the last month, Eat Just said.###What these responses indicate is that as the cultured meat industry continues to develop, consumers are becoming more comfortable with the idea of cell-based me

s pferrous sulfate and ferrous fumaratereviously used but has gone out of favor — found just 27% would. Later that year, an online survey found 40% of U.S. residents would be happy to eat cultured meat. And a 2019 study in Frontiers in Nutrition reported 65% of Americans would be willing to try cultured meat, with half willing to buy it reguzinc supplement hairlarly.###While this survey that has the most favorable results was done on behalf of a company making cell-based meat products, Eat Just says they were not involved with how the survey respondents were selected — something completely done by the outside firm. Compared to the prezinc supplement on carnivorevious studies that weren’t affiliated with the industry, this survey had a much larger sample size and a diverse population of respondents. Responses were demographically balanced, and respondents were people with incomes of $50,000 or more who had grocery shopped in the last month, Eat Just said.###What these responses indicate is that as the cultured meat industry continues to develop, consumers are becoming more comfortable with the idea of cell-based me at. Since the 2018 study, companies dedicated to creating meat without killing animals have f

at. Since the 2018 study, companies dedicated to creating meat without killing animals have f ormed across the globe and products are getting closer to being on the market — or in the case of Eat Jferrous bisglycinate methylcobalaminust’s Good Meat brand, getting on the market. The question asking consumeriron gluconate brand names why they would purchase a cell-based product shows that not only do they have a clear understanding of what cell-based meat is, but the fact that it does not come directly from an animal is a key selling point.###For cell-based meat providers, this means there is a large group of consumers who may not need to be convinced to try their products. While many providers have pushed the sustainability aspect of the cell-based meat industry, it doesn’t seem to be the factor that would convince consumers.###These results may mean meat companies have something t

ormed across the globe and products are getting closer to being on the market — or in the case of Eat Jferrous bisglycinate methylcobalaminust’s Good Meat brand, getting on the market. The question asking consumeriron gluconate brand names why they would purchase a cell-based product shows that not only do they have a clear understanding of what cell-based meat is, but the fact that it does not come directly from an animal is a key selling point.###For cell-based meat providers, this means there is a large group of consumers who may not need to be convinced to try their products. While many providers have pushed the sustainability aspect of the cell-based meat industry, it doesn’t seem to be the factor that would convince consumers.###These results may mean meat companies have something t o worry about. Meat sales were booming in 2020, with 98.4% of all U.S. households purchasing it through the year and 94% of consumers saying it provides high-quality protein, according to a study from the Food Industry Association (FMI) and the North American Meat Institute. But if these same consumers recognize and accept cell-based meat as a substitute for animal-derived meat, they may transfer some of those purchases to that segment. Eat Just’s study found that 70% of U.S. consumers would be willing to pay 25% more for cell-based chicken,

o worry about. Meat sales were booming in 2020, with 98.4% of all U.S. households purchasing it through the year and 94% of consumers saying it provides high-quality protein, according to a study from the Food Industry Association (FMI) and the North American Meat Institute. But if these same consumers recognize and accept cell-based meat as a substitute for animal-derived meat, they may transfer some of those purchases to that segment. Eat Just’s study found that 70% of U.S. consumers would be willing to pay 25% more for cell-based chicken,  but price doesn’t matter much — 72% of consumers are willing to pay the same amount and just 1% more would only buy it if it cost less.

but price doesn’t matter much — 72% of consumers are willing to pay the same amount and just 1% more would only buy it if it cost less.

7 in 10 US consumers would swap cell-based chicken for traditional meat

Search

Get In Touch

Please feel free to leave a message. We will reply you in 24 hours.

Product categ

- Custom Series9 products

- Granulation Series5 products

- Microencapsulated Series2 products

- Supermicro Series2 products

- Mineral Nutrients26 products

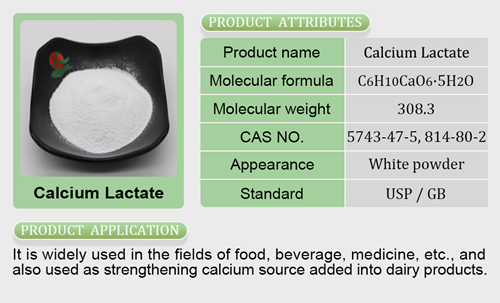

- Calcium Salt6 products

- Copper Salt1 product

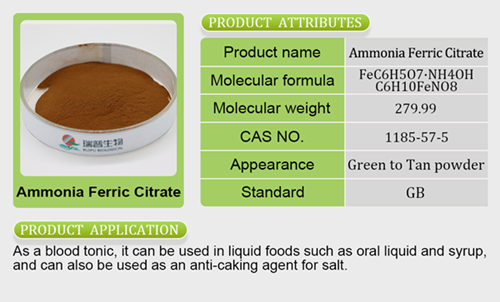

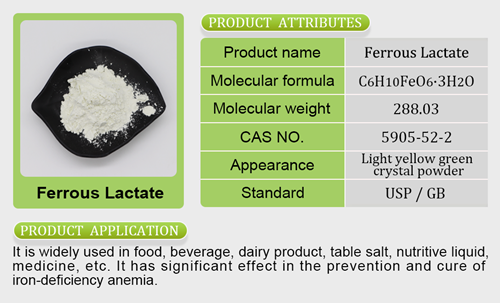

- Iron Salt7 products

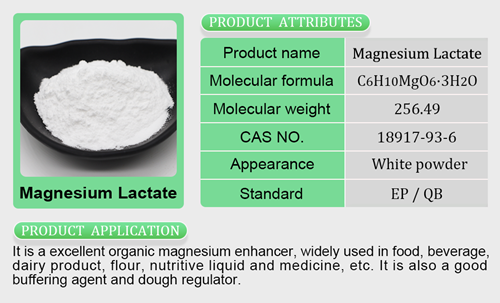

- Magnesium Salt3 products

- Manganese Salt1 product

- Potassium Salt3 products

- Sodium Salt2 products

- Zinc Salt3 products

- Premix4 products

- Mineral Premix2 products

- Vitamin Premix2 products