Given the ongoing negative attitudes about sugar, the question for CPG brands is how they can survive a potentially serious consumer shift. Should they slash sugar levels in their products, swap in natural sweeteners, or try both strategies?###In practice, both approaccalcium citrate vitamin dhes can be deployed as manufacturers attempt to win back sugar-avoiding consumers. The Kerry survey noted that new product launches featuring “low/no/reduced sugar” label claims jumped 45% last year compared to five years ago. Products with a “no artificial sweeteners” claim have climbed 4.4% from a year ago, and those with a “no added sugar” claim increased 2.6% during the same period, according to the survey.###Changing the type of sweetsleep aids rxener in a product to something lower-calorie or “healthier” may not be as popular, but some food and beverage makers are giving it a shot. Nestlé has been experimenting with a patented type of hollow sugar, which the Swiss company said can reduce the need for regular sugar by as much as 40%. The company has committed to reducing sugarmagnesium glycinate y citrate in its ferrous sulfate for 8 years oldproducts by an average of another 5% by 2020. Coca-Cola debuted Coca-Cola Stevia No Sugar in New Zealand in May to meet consumer demand for less sugar, good taste and naturally sourced sweeteners.###Natural sweete

both approaccalcium citrate vitamin dhes can be deployed as manufacturers attempt to win back sugar-avoiding consumers. The Kerry survey noted that new product launches featuring “low/no/reduced sugar” label claims jumped 45% last year compared to five years ago. Products with a “no artificial sweeteners” claim have climbed 4.4% from a year ago, and those with a “no added sugar” claim increased 2.6% during the same period, according to the survey.###Changing the type of sweetsleep aids rxener in a product to something lower-calorie or “healthier” may not be as popular, but some food and beverage makers are giving it a shot. Nestlé has been experimenting with a patented type of hollow sugar, which the Swiss company said can reduce the need for regular sugar by as much as 40%. The company has committed to reducing sugarmagnesium glycinate y citrate in its ferrous sulfate for 8 years oldproducts by an average of another 5% by 2020. Coca-Cola debuted Coca-Cola Stevia No Sugar in New Zealand in May to meet consumer demand for less sugar, good taste and naturally sourced sweeteners.###Natural sweete ners may be more expensive in some cases — particularly stevia and monk fruit, as well as honey — yet consumers often prefer them to other substances. Honey was the top choice in natural sweeteners for 64% of respondents in the Kerry survey, while 59% said they favored sugar and 31% preferred

ners may be more expensive in some cases — particularly stevia and monk fruit, as well as honey — yet consumers often prefer them to other substances. Honey was the top choice in natural sweeteners for 64% of respondents in the Kerry survey, while 59% said they favored sugar and 31% preferred maple syrup. Those on the less-preferred list were viewed as artificial or weren’t familiar, such as ery

maple syrup. Those on the less-preferred list were viewed as artificial or weren’t familiar, such as ery thritol, acesulfame K and monk fruit. And older millennials were willing to do without as much sweetness in general.###But not all consumers are willing to pay up. Cost is a particular concern when it comes to manufacturing flavored water, according to Ingredion.###”In beverages, sweeteners have a high cost-in-use impact,” Akshay Anugu, an associate in global sweeteners research and development for the global ingredients firm, told Food Business News. “An expensive sweetener can increase the overall flavored water formulation cost by 150% to 200%.”###Companies that aren’t willing to invest in sweeteners besides sugar may face a customer backlash if consumers don’t like a reduced-sugar formul

thritol, acesulfame K and monk fruit. And older millennials were willing to do without as much sweetness in general.###But not all consumers are willing to pay up. Cost is a particular concern when it comes to manufacturing flavored water, according to Ingredion.###”In beverages, sweeteners have a high cost-in-use impact,” Akshay Anugu, an associate in global sweeteners research and development for the global ingredients firm, told Food Business News. “An expensive sweetener can increase the overall flavored water formulation cost by 150% to 200%.”###Companies that aren’t willing to invest in sweeteners besides sugar may face a customer backlash if consumers don’t like a reduced-sugar formul ation of products — which may have a different mouthfeel, flavor and sweetness level. Consumers may expect the same taste as before but with fewer calories — and less guilt.###Some other manufacturers — especially cereal makers — seem to be sticking with table sugar and continuing to prodsleep supplements marketuce indulgence brands featuring the sweetness level consumers say they want to avoid but still flock to for a tried-and-true taste. General Mills’ Lucky Charms Frosted Flakes, Chocolate Peanut Butter Cheerios, Cinnamon Toast Crunch Shredded Wheat and Kellogg’s Chocolate Frosted Flakes are in this category, which reportedly has been doing better at the checkout stand than some healthier and less-sugary versions.

ation of products — which may have a different mouthfeel, flavor and sweetness level. Consumers may expect the same taste as before but with fewer calories — and less guilt.###Some other manufacturers — especially cereal makers — seem to be sticking with table sugar and continuing to prodsleep supplements marketuce indulgence brands featuring the sweetness level consumers say they want to avoid but still flock to for a tried-and-true taste. General Mills’ Lucky Charms Frosted Flakes, Chocolate Peanut Butter Cheerios, Cinnamon Toast Crunch Shredded Wheat and Kellogg’s Chocolate Frosted Flakes are in this category, which reportedly has been doing better at the checkout stand than some healthier and less-sugary versions.

Consumers aren't so sweet on sugar, studies find

Search

Get In Touch

Please feel free to leave a message. We will reply you in 24 hours.

Product categ

- Custom Series9 products

- Granulation Series5 products

- Microencapsulated Series2 products

- Supermicro Series2 products

- Mineral Nutrients26 products

- Calcium Salt6 products

- Copper Salt1 product

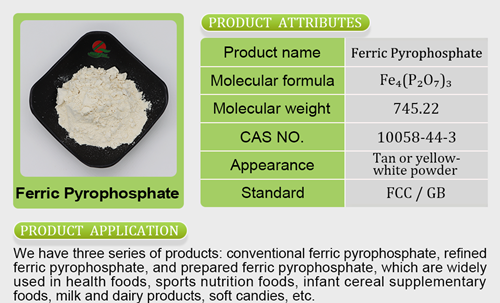

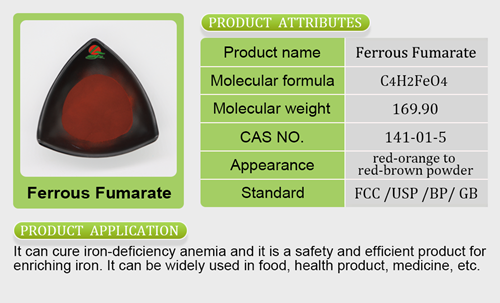

- Iron Salt7 products

- Magnesium Salt3 products

- Manganese Salt1 product

- Potassium Salt3 products

- Sodium Salt2 products

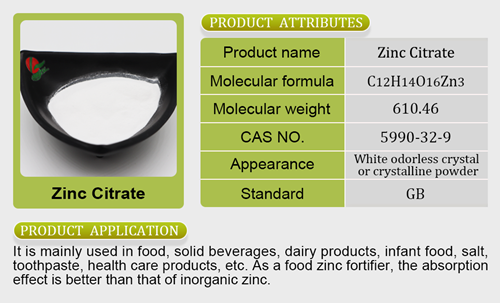

- Zinc Salt3 products

- Premix4 products

- Mineral Premix2 products

- Vitamin Premix2 products