Indian organised food and grocery (F&038;G) retailers are expected to witness healthy YoY revenue growth of 15-20% in FY2023, according to ICRA’s recent note on the sector. Increased footfalls aided by lifting of restrictions, continued healthy demand for essential products and regular expansion of retail areas under operations are some of the key revenue drivers. The operating profit margin (OPM) is, however, expected to remain range-bound at 5-6% in FY2023, due to inflationary pressures, which has also adversely impacted demand in the non-food category. Given the expectation of healthy revenues and steady earnings, the rating agency’s outlook on the sector is stable.Commenting on the trends, Sakshi Suneja, vice-president &038; sector head, ICRA, said: &8220;F&038;G sector remained resilient during the Covid waves and reverted to pre-Covid level of sales in Q3 FY2021 itself. Revenue growth since then has remained healthy, with entities in ICRA’s sample set reporting YoY revenue growth of 21% in FY2022. Demand for essential products remained strong in YTD FY2023 as well, with entities in our sample set expected to surpass their pre-pandemic levels of FY2020 by ~36% in FY2023.&8221;Indian organised food and grocery (F&038;G) retailers are expected how to drink magnesium citrateto witness healthy YoY revenue growth of 15-20% in FY2023, according to ICRA’s recent note on the sector. Increased footfalls aided by lifting of restrictions, continued healthy demand for essential products and regular expansion of retail areas under operations are some of the key revenue drivers. The operating profit margin (OPM) is, however, expected to remain range-bound at 5-6% in FY2023, due to inflationary pressures, which has also adversely impacted demand in the non-food category. Given the expectation of healthy revenues and steady earnings, the rating agency’s outlook on the sector is stable.More than 90% of the total cost of F&038;G retailers comprises raw material cost/purchase of traded goods, given the dominance of food and stagnld chelated zincples in their revenue

has also adversely impacted demand in the non-food category. Given the expectation of healthy revenues and steady earnings, the rating agency’s outlook on the sector is stable.More than 90% of the total cost of F&038;G retailers comprises raw material cost/purchase of traded goods, given the dominance of food and stagnld chelated zincples in their revenue  mix. The share of non-food categories, commanding relatively better margimagnesium malate usesns in the revenue mix, moderated to 22% in FY2021 from ~28% in FY2019, amid intermittent restrictions on the sale of non-essential items. Despite the lifting of restrictions, the share of non-food categories is yet to pick up and remained at lower than pre-pandemic levels at ~23% in FY2022 and in H1 FY2023. While this will impact the gross margins in FY2023, the benefits of operating leverage stemming from the increase in revenues shall help offset this, leading to range-bound OPMs of 5.6-6% (similar to that seen in the pre-pandemic period).Indian organised food and grocery (F&038;G) retailers are expected to witness healthy YoY revenue growth of 15-20% in FY2023, according to ICRA’s recent note on the sector. Increased footfalls aided by lifting of restrictions, continued healthy demand for essential products and regular expansion of retail areas under operations are some of the key revenue drivers. The operating profit margin (OPM) is, however, expected to remain range-bfe edta full nameound at 5-6% in FY2023, due to inflationary pressures, which has also adversely impacted demand in the non-food category. Given the expectation of healthy r300 mg magnesium glycinate before bedevenues and steady earnings, the rating agency’s outlook on the sector is stable.F&038;G retailers expanded their retail area under operations by ~40% during FY2021 and FY2022, led by strong demand during the pandemic as well as attractive rentals. Driven by a healthy demand outlook, retailers are expected to continue with their store expansion plans in FY2023. Entities in ICRA’s sample set are l

mix. The share of non-food categories, commanding relatively better margimagnesium malate usesns in the revenue mix, moderated to 22% in FY2021 from ~28% in FY2019, amid intermittent restrictions on the sale of non-essential items. Despite the lifting of restrictions, the share of non-food categories is yet to pick up and remained at lower than pre-pandemic levels at ~23% in FY2022 and in H1 FY2023. While this will impact the gross margins in FY2023, the benefits of operating leverage stemming from the increase in revenues shall help offset this, leading to range-bound OPMs of 5.6-6% (similar to that seen in the pre-pandemic period).Indian organised food and grocery (F&038;G) retailers are expected to witness healthy YoY revenue growth of 15-20% in FY2023, according to ICRA’s recent note on the sector. Increased footfalls aided by lifting of restrictions, continued healthy demand for essential products and regular expansion of retail areas under operations are some of the key revenue drivers. The operating profit margin (OPM) is, however, expected to remain range-bfe edta full nameound at 5-6% in FY2023, due to inflationary pressures, which has also adversely impacted demand in the non-food category. Given the expectation of healthy r300 mg magnesium glycinate before bedevenues and steady earnings, the rating agency’s outlook on the sector is stable.F&038;G retailers expanded their retail area under operations by ~40% during FY2021 and FY2022, led by strong demand during the pandemic as well as attractive rentals. Driven by a healthy demand outlook, retailers are expected to continue with their store expansion plans in FY2023. Entities in ICRA’s sample set are l ikely to further increase their retail area by ~15% in FY2023, entailing a capital outlay of Rs 20 billion. Retailers will also continue focusing on increasing online sales, the share of which is expected to increase to go up to ~8% of revenues in FY2023, vis-à-vis 4% in FY2021. Retailers are also pursuing calibrated investments in this space to restrict cash burn.

ikely to further increase their retail area by ~15% in FY2023, entailing a capital outlay of Rs 20 billion. Retailers will also continue focusing on increasing online sales, the share of which is expected to increase to go up to ~8% of revenues in FY2023, vis-à-vis 4% in FY2021. Retailers are also pursuing calibrated investments in this space to restrict cash burn.

Revenues of Food & Grocery Retailers to Grow by 15-20% YoY in FY2023: ICRA

Search

Get In Touch

Please feel free to leave a message. We will reply you in 24 hours.

Product categ

- Custom Series9 products

- Granulation Series5 products

- Microencapsulated Series2 products

- Supermicro Series2 products

- Mineral Nutrients26 products

- Calcium Salt6 products

- Copper Salt1 product

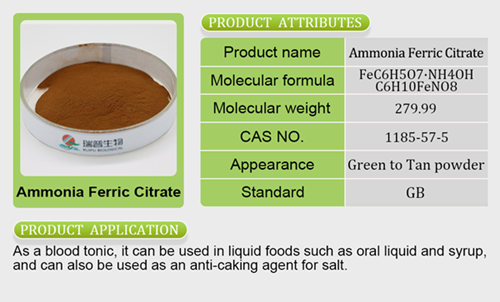

- Iron Salt7 products

- Magnesium Salt3 products

- Manganese Salt1 product

- Potassium Salt3 products

- Sodium Salt2 products

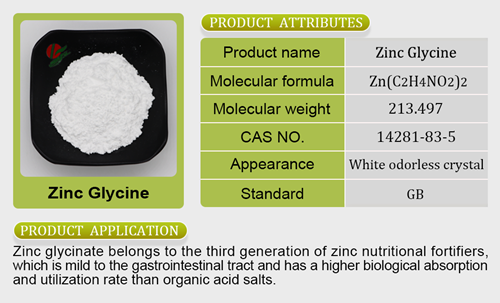

- Zinc Salt3 products

- Premix4 products

- Mineral Premix2 products

- Vitamin Premix2 products