B&G Foods has had reason to question its business structure and find a new solution. In March 2021, the company’s former interim CEO said in an earnings call that commodity price inflation and supply shortages caused it to miss out on sales.###In B&G Foods’ most recent earnings call last month, current President and CEO Casey Keller said the company aims for the restructuring to be cost-neutral.###“It’s largely reorganizing ourselves to kind of create multifunctional units which are driving aspects of our business and have people make decisions that are closer to the business in more real

have people make decisions that are closer to the business in more real time,” Keller said.###B&G’s decision to change how its business is structured makes sense, given the wide range of food sectors that it reaches, and the large ingredient pool it sources from. The company is known for a diverse variety of food items. In nonfood, it also makes anti-static spray Static Guard.###Specialty, which includes brands like Clabber Girl and Crisco, makes up nearly a third of B&G’s net sales. Frozen and vegetables is responsible for 27%; meal products like Cream of Wheat and Victoria contribute 22%; and spices and seasonings like Ac’cent and Dash comprise 18% of the company’s sales.###In the last quarter, shortages and price increases led to the company’s earnings before interest, taxes, debt and amortization (EBITDA) to decline 16.2% versus the first quarter of 2021. It attributed the dropferrous gluconate is iron largely to higher costs of commodities like oil, wheat and corn stemming from the Ukraine war.###A key aspect of the reorganization concerns the potential sale of particular brands. When a company divides its portfolio into different areas, it is more likely to have a better handle on its brands and know which ones to offload. The possibility that B&G co

time,” Keller said.###B&G’s decision to change how its business is structured makes sense, given the wide range of food sectors that it reaches, and the large ingredient pool it sources from. The company is known for a diverse variety of food items. In nonfood, it also makes anti-static spray Static Guard.###Specialty, which includes brands like Clabber Girl and Crisco, makes up nearly a third of B&G’s net sales. Frozen and vegetables is responsible for 27%; meal products like Cream of Wheat and Victoria contribute 22%; and spices and seasonings like Ac’cent and Dash comprise 18% of the company’s sales.###In the last quarter, shortages and price increases led to the company’s earnings before interest, taxes, debt and amortization (EBITDA) to decline 16.2% versus the first quarter of 2021. It attributed the dropferrous gluconate is iron largely to higher costs of commodities like oil, wheat and corn stemming from the Ukraine war.###A key aspect of the reorganization concerns the potential sale of particular brands. When a company divides its portfolio into different areas, it is more likely to have a better handle on its brands and know which ones to offload. The possibility that B&G co uld actively sell some of its brands would mark a dramatic shift for the company that has a reputation for being a serial acquirer. One of the few sales made by B&G in recent years was in 2018 when it divested Pirate Brands, the maker of Pirate’s Booty, to Hershey for $420 million.###“These units will decan you take magnesium citrate everydayfine the categories and brands that we will resourcevitamin c and ferrous sulfate and grow, the platforms for future acquisitions, the brands that will run for efficiency and cash flow, and the buswhat is liposomal ironinesses we may exit over time,” Keller said in the press release.###Food

uld actively sell some of its brands would mark a dramatic shift for the company that has a reputation for being a serial acquirer. One of the few sales made by B&G in recent years was in 2018 when it divested Pirate Brands, the maker of Pirate’s Booty, to Hershey for $420 million.###“These units will decan you take magnesium citrate everydayfine the categories and brands that we will resourcevitamin c and ferrous sulfate and grow, the platforms for future acquisitions, the brands that will run for efficiency and cash flow, and the buswhat is liposomal ironinesses we may exit over time,” Keller said in the press release.###Food and beverage companies restructuring their business or portfolios has become more common as consumer interests change and the business environment becomes more complicated. This week Kellogg annvitamin d3 k2

and beverage companies restructuring their business or portfolios has become more common as consumer interests change and the business environment becomes more complicated. This week Kellogg annvitamin d3 k2 magnesium glycinate zincounced plans to split into three separate companies: cereal, snacks and plant-based foods.

magnesium glycinate zincounced plans to split into three separate companies: cereal, snacks and plant-based foods.

B&G Foods creates 4 business units to oversee sprawling portfolio

Search

Get In Touch

Please feel free to leave a message. We will reply you in 24 hours.

Product categ

- Custom Series9 products

- Granulation Series5 products

- Microencapsulated Series2 products

- Supermicro Series2 products

- Mineral Nutrients26 products

- Calcium Salt6 products

- Copper Salt1 product

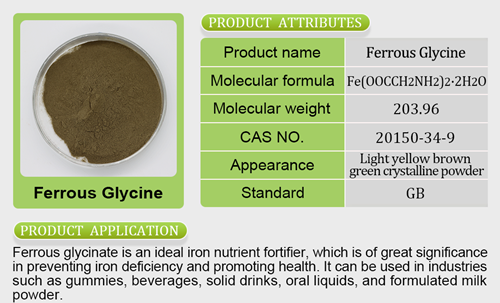

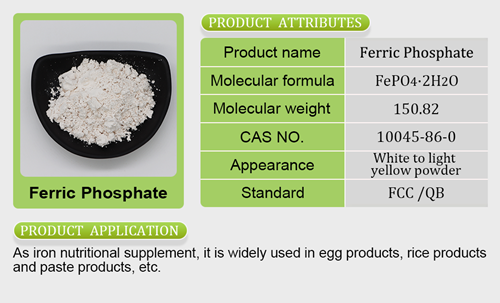

- Iron Salt7 products

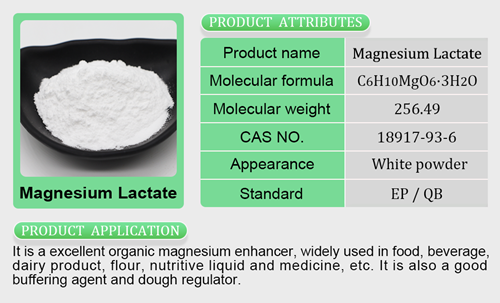

- Magnesium Salt3 products

- Manganese Salt1 product

- Potassium Salt3 products

- Sodium Salt2 products

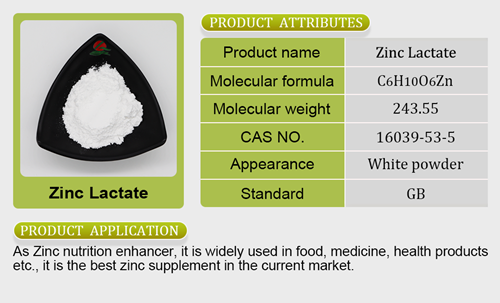

- Zinc Salt3 products

- Premix4 products

- Mineral Premix2 products

- Vitamin Premix2 products