While snacking is often thought of as an indulgent and convenient alternative to traditional meal times, many consumers are now focusing on their health, creating new opportunity for healthy snacks. ###Mintel’s report reveals that 40% of urban Chinese consumers eat more nuts and seeds today compared to six months ago.###Pointing to the rise in popularity of these healthy snacks, 58% of consumers say that nuts and seeds taste good and 44% say they are convenient to eat, while only 9% say nuts and seeds are unhealthy.###It seems that nuts are high in demand in China as product launch activity is also on the rise.###Mintel Global New Products Database (GNPD) reveals that 17.5% of snack products launched in China between 2014 and 2016 were nuts, compared to 15.3% of those launched globally.###The healthy snacking trend is contributing to the growing popularity of nuts and seeds in retail channels as well. ###In China’s retail snack market, nuts and seeds is the largest category, with a retail value of RMB263.7 billion (US$38.27).###The segment is forecast to grow at a compound annual growth rate of 10.7% in terms of value between 2015 and 2020, reaching RMB345.6 billion.###“Chinese consumers have become more aware of the health benefits of nuts and seeds,” says Ching Yang, senior food and drink analyst.###“Now, it seems that eating nuts and seeds is no longer something to do to kill tiwhole foods magnesium citrateme while chatting with friends, but part of the overall pursuit of a healthy and trendy lifestyle.”###“Thereforezinc oxide and zinc gluconate, companies should consider packing up the traditional nuts and seeds bulk products in favor of branded products that are positioned as a healthy snack.”###“We’re seeing a number of thmagnesium citrate what is it fore nuts brands thriving when leveraging this consumer trend.”###Defining healthy snacks###Mintel research reveals that 61% of consumers associate a healthy snack with ‘all-natural’, while 42% associate it with ‘fortified with additional nutrients’.###Meanwhile, 31% of Chinese consumers associate healthy snacks with ‘high in protein’, and the demographic skews towards male consumers aged 25-29 (42%).###Furthermore, 41% of Chinese consumers aged 40-49 associate healthy snacks with ‘low in salt’.###Snack types###According to Mintel GNPD, one quarter of snack products launched in China between 2014 and 2016 were meat- or seafood-based snacks. ###And 48% of consumers think meat/seafood-based snacks taste good and are filling (46%).###On the other hand, the growth rates of traditional sweet snacks, such as sugar confectionery, ice cream and biscuits, are relatively slow. ###About 26% of urban Chinese consumers are eating less chocolate confectionery today compared to six months ago, while 23% are eating mo re. ###However, 63% of Chinese consumers are eating more fresh fruits and vegetables as snacks, and 42% are eating more dairy-based snacks.###“Chinese consumers have rising awareness of their sugar and fat intake,” says Yang.###“Therefore, more cons

re. ###However, 63% of Chinese consumers are eating more fresh fruits and vegetables as snacks, and 42% are eating more dairy-based snacks.###“Chinese consumers have rising awareness of their sugar and fat intake,” says Yang.###“Therefore, more cons umers are switching to fresh fruits and vegetables or dairy-based foods for snacking.”###“Th

umers are switching to fresh fruits and vegetables or dairy-based foods for snacking.”###“Th is suggests a growing opportunity for food and drinks brands that enjoy a healthy perception (e.g. dietary supplements, cereals and yogurt) to tap into the snacking occasion by developing snack format products.”###“Our research shows that Chinese females are concerned with calories, while Chinese males care about protein.”###“With this in mind – and the fact that the

is suggests a growing opportunity for food and drinks brands that enjoy a healthy perception (e.g. dietary supplements, cereals and yogurt) to tap into the snacking occasion by developing snack format products.”###“Our research shows that Chinese females are concerned with calories, while Chinese males care about protein.”###“With this in mind – and the fact that the  average sodium level in China’s meat snacks is lower than the global average and the level is decreasing over time – the ‘reduced sodium’ claim is still rarel

average sodium level in China’s meat snacks is lower than the global average and the level is decreasing over time – the ‘reduced sodium’ claim is still rarel y seen on meat snacks and, therefore, could be leveraged to meet consumer needs.”###Buying behavior###Imported snacks are gaining popularity among urban Chinese consumers.###Some 42% of urban Chinese consumers are interested in buying imported products they have never tried before across a variety of purchase channels that specialize in selling imported snacks. ###Of themagnesium citrate 500se same urban consumers, while 34% have bought snacks from imported food stores, 28% have bought at local stores when travelling and 19% have bought from foreign shopping websites. ###In addition, though 75% of consumers have bought snacks from any e-commerce site, physical retail channels are still the most popular purchase destination (96%).###“As consumers continue to look for new and different ferrous fumarate oralflavor experiences, international snacks have become a sector that many consumers are gravitating towards,” said Yang.###“E-commerce is an especially important channel for international snacks.” ###“It not only allows consumers to easily access foreign products, but also provides a less costly channel for international players to enter the Chinese market.”###“However, one of the challenges for consumers is deciding what products are good and worth the higher cost, especially for consumers living in tier-one cities as they are more likely to shop online.”###“A product targeting mainstream consumers could use regular retail channels in order to reach more consumers, especially in the lower tier cities.”

y seen on meat snacks and, therefore, could be leveraged to meet consumer needs.”###Buying behavior###Imported snacks are gaining popularity among urban Chinese consumers.###Some 42% of urban Chinese consumers are interested in buying imported products they have never tried before across a variety of purchase channels that specialize in selling imported snacks. ###Of themagnesium citrate 500se same urban consumers, while 34% have bought snacks from imported food stores, 28% have bought at local stores when travelling and 19% have bought from foreign shopping websites. ###In addition, though 75% of consumers have bought snacks from any e-commerce site, physical retail channels are still the most popular purchase destination (96%).###“As consumers continue to look for new and different ferrous fumarate oralflavor experiences, international snacks have become a sector that many consumers are gravitating towards,” said Yang.###“E-commerce is an especially important channel for international snacks.” ###“It not only allows consumers to easily access foreign products, but also provides a less costly channel for international players to enter the Chinese market.”###“However, one of the challenges for consumers is deciding what products are good and worth the higher cost, especially for consumers living in tier-one cities as they are more likely to shop online.”###“A product targeting mainstream consumers could use regular retail channels in order to reach more consumers, especially in the lower tier cities.”

Asia Pacific: Healthy snackingnatural factors calcium and magnesium on the rise in China, report

Search

Get In Touch

Please feel free to leave a message. We will reply you in 24 hours.

Product categ

- Custom Series9 products

- Granulation Series5 products

- Microencapsulated Series2 products

- Supermicro Series2 products

- Mineral Nutrients26 products

- Calcium Salt6 products

- Copper Salt1 product

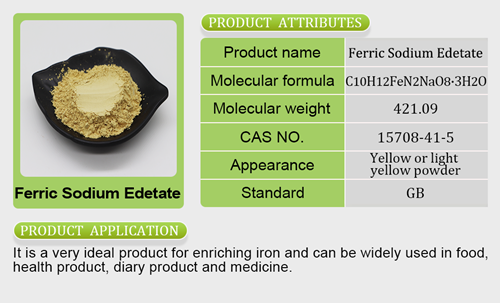

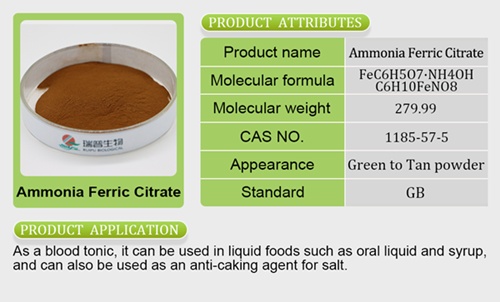

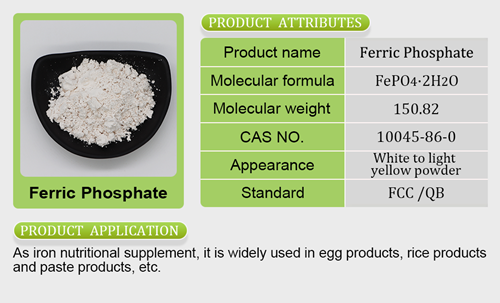

- Iron Salt7 products

- Magnesium Salt3 products

- Manganese Salt1 product

- Potassium Salt3 products

- Sodium Salt2 products

- Zinc Salt3 products

- Premix4 products

- Mineral Premix2 products

- Vitamin Premix2 products