Reinventing cheese as a naturally-healthier snack is the biggest growth opportunity for dairy companies, reveals New Nutrition Business in its new report, 10 Key Trends in the Business of Dairy Nutrition.###Cheese has had a major boost from scientific research showing that it is one of nature’s ‘naturally functional’ whole foods, with no negatives either from fat or sodium content. ###Now, new sales numbers show that connecting cheese to the snackification trend spells market success.###One of the most successful products launched in the US, with first year sales hitting US$67 million, is Sargento Balanced Breaks, a snack that pairs cheese with fruit and nuts. ###It highlights the convenience of a snack and cheese’s naturally-nutritious properties.###The company retail its products at 150% premium to regular mass-market cheese. ###“For profitable growth, premium niches are the highest-opportunity, least-risk targets in dairy. In almost every case the most effective strategy for profitable dairy growth is to begin by focusing on the low-volume, high-value segments of the market”, says Julian Mellentin, dirzinc citrate usp monographector of New Nutrition Business.###Meanwhile, Spire Brands’ Moon Cheese snack – dried pieces of Gouda, Cheddar, or Pepper Jack in a convenient pack – hit a US$10-million run rate in early 2016 with prospects to double annual revenues to about US$20 million in 2017.###For years cheese has been out of favor because of its high fat content and faulty research linking it to cardiovascular disease. ###However, new consumer awareness about the healthealth aid magnesium citrateh benefits of cheese means there is scope for growth in countries where cheese consumption has been low. ###If US consumers were to reach the same per capita consumption of cheese as France, for example, the US  market would double in size.###Dare to be dairy-free###Just when a critical mass of science revealed that dairy is a natural whole-food with a wealth of health benefits, it is faced with some new negatives (thanks to online bloggers), anlife magnesium citrated these are helping fuel the dairy-f

market would double in size.###Dare to be dairy-free###Just when a critical mass of science revealed that dairy is a natural whole-food with a wealth of health benefits, it is faced with some new negatives (thanks to online bloggers), anlife magnesium citrated these are helping fuel the dairy-f ree trend.###Danone has turned non-dairy into an opportunity by acquiring WhiteWave, thus becoming both one of the world’s biggest dairy companies and t

ree trend.###Danone has turned non-dairy into an opportunity by acquiring WhiteWave, thus becoming both one of the world’s biggest dairy companies and t he world’s biggest non-dairy company.###Almond and coconut milk brands have been capitalizin

he world’s biggest non-dairy company.###Almond and coconut milk brands have been capitalizin g on people’s interest in digestive health (one of the most powerful trends in the food and

g on people’s interest in digestive health (one of the most powerful trends in the food and beverage industry), positioning themselves as ‘easier to digest’ than dairy milk. ###Addressing people’s worries about dairy andcitracal d3 maximum plus digestive wellness presents a wealth of opportunities for dairy, as the A2 cows’ milk brand has demonstrated in Australia, where it has taken a 12% sharezinc citrate 50mg capsules of the liquid milk market with its ‘easy to digest’ marketing message.###

beverage industry), positioning themselves as ‘easier to digest’ than dairy milk. ###Addressing people’s worries about dairy andcitracal d3 maximum plus digestive wellness presents a wealth of opportunities for dairy, as the A2 cows’ milk brand has demonstrated in Australia, where it has taken a 12% sharezinc citrate 50mg capsules of the liquid milk market with its ‘easy to digest’ marketing message.###

Americas: Cheese becomes tcalcium citrate plus vit drendy as healthy snacks

Search

Get In Touch

Please feel free to leave a message. We will reply you in 24 hours.

Product categ

- Custom Series9 products

- Granulation Series5 products

- Microencapsulated Series2 products

- Supermicro Series2 products

- Mineral Nutrients26 products

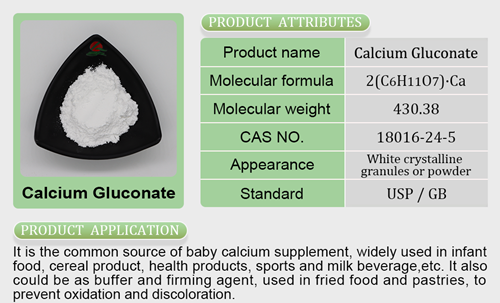

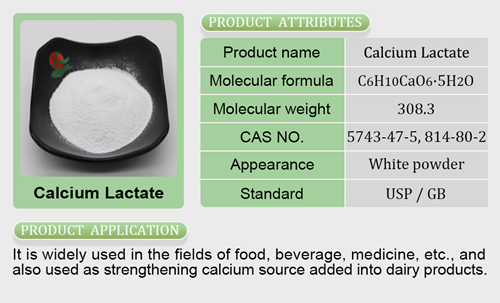

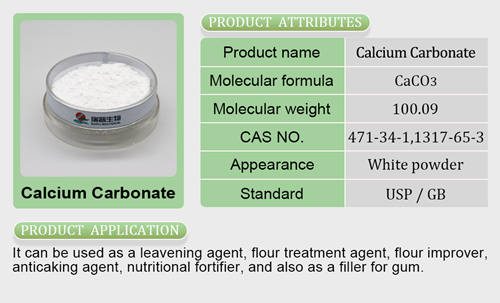

- Calcium Salt6 products

- Copper Salt1 product

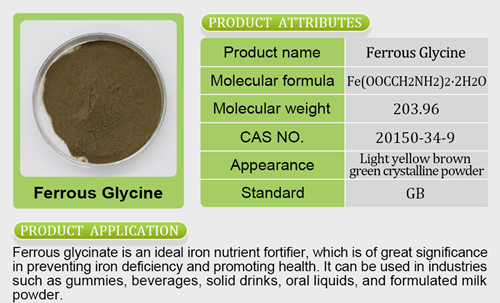

- Iron Salt7 products

- Magnesium Salt3 products

- Manganese Salt1 product

- Potassium Salt3 products

- Sodium Salt2 products

- Zinc Salt3 products

- Premix4 products

- Mineral Premix2 products

- Vitamin Premix2 products